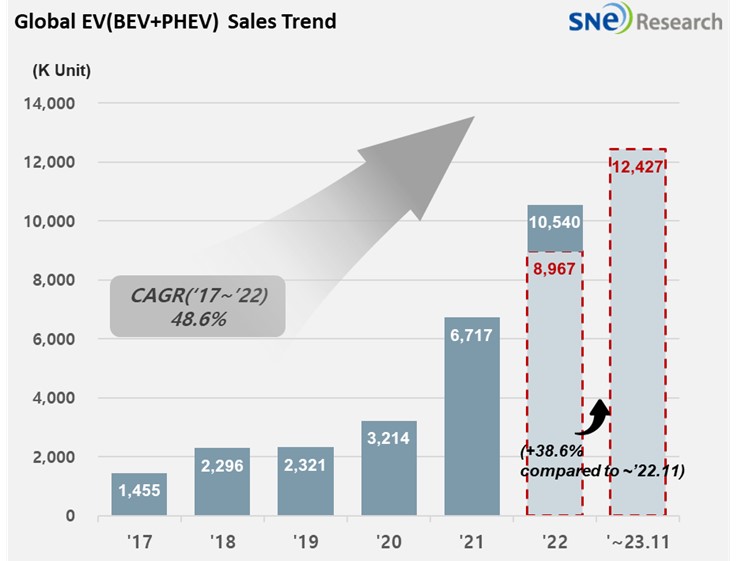

From Jan to Nov in 2023, Global[1] Electric Vehicle Deliveries[2] Posted 12.427 Mil Units, a 38.6% YoY Growth

- BYD took No. 1 and Tesla ranked 2nd in the global EV market

From

Jan to Nov in 2023, the total number of electric vehicles registered in countries

around the world was approximately 12.427 million units, a 38.6% YoY increase.

(Source: Global EV and Battery Monthly Tracker – Dec 2023, SNE Research)

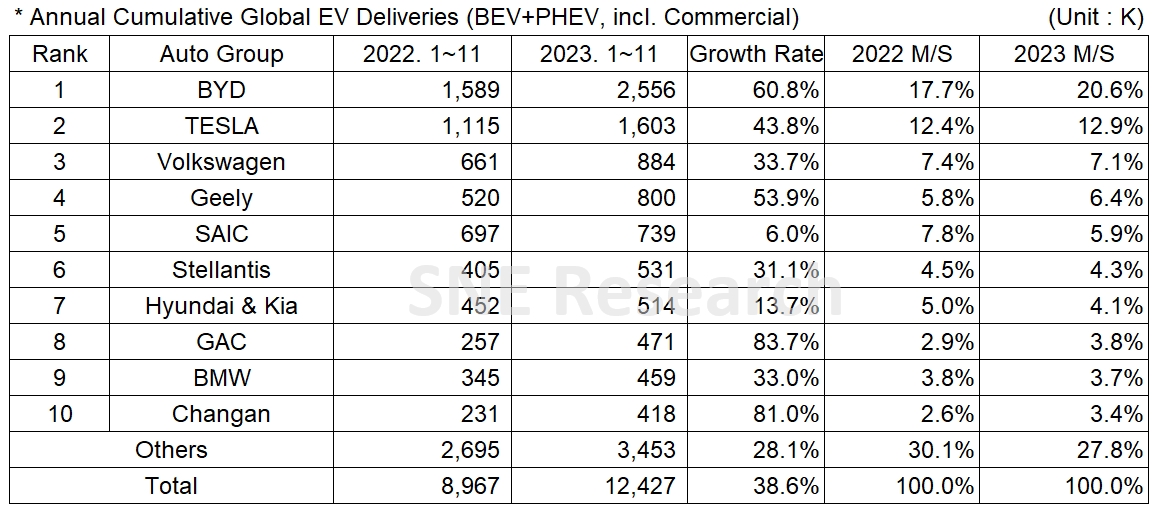

In the global EV sales by major OEMs from Jan to November in 2023, the leading EV company in China, BYD posted a 60.8% YoY growth and kept the top position in the global market. BYD took up the largest pie based on its variety of line-up including Song, Yuan Plus (Atto3), Dolphin, and Qin. Among these models, Song recorded a 30.1% YoY growth, positioning itself as a bestselling model and leading the growth moment of BYD. Tesla, delivering more than 1.6 million units to customers, recorded a 43.8% YoY growth. Tesla’s main models – Model 3 and Y – enjoyed favorable sales, and with the delivery of Model 3 facelift Highland started in Europe, the sale of Model 3 rebounded after a temporary slowdown. The Volkswagen Group, ranked 3rd on the list, posted a 33.7% growth by delivering approx. 880k units to customers mainly with ID.3/4/5, Audi Q4, Q8 E-Tron, and Skoda ENYAQ model.

(Source: Global EV and Battery Monthly Tracker – Dec 2023, SNE

Research)

Hyundai-KIA Group recorded a 13.7% YoY growth by selling more than 510k units of IONIQ 5/6, EV6, Niro, and Kona. The Group, who broke the record of the highest performance again, recently announced that it would increase the sale of eco-friendly vehicles by continuously strengthening hybrid line-up and also enhance the global awareness of its dedicated EV brand, IONIQ.

(Source: Global EV and Battery Monthly

Tracker – Dec 2023, SNE Research)

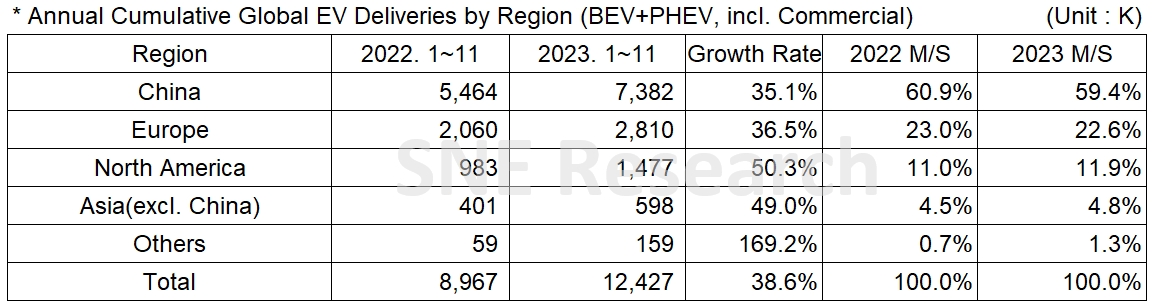

By

region, China firmly took up the biggest share of the global EV market,

recording 59.4% of market share. China’s current growth momentum is mainly led

by BYD who both supplies battery to its own vehicles and manufactures electric

vehicles. BYD, who secured price competitiveness through vertical integration

and focused on new-energy cars after stopping the production of ICE vehicles,

have sold approx. 2.556 million units in China this year. Given the total sales

of new-energy cars in China this year being 7.382 million units, it can be said

that among 3 new-energy cars sold in China, one should be made by BYD.

According to various media sources, as of Q4 2023, the total sales of BEV by BYD exceeded those of Tesla for the first time in history, pushing BYD to the top position on the list for Q4 2023 EV sales. On the other hand, Xiaomi, a Chinese manufacturer of consumer electronics, unveiled ‘SU7,’ its new EV model scheduled to be launched in 2024, adding more momentum to the growing influence of Chinese companies in the global auto industry. The growth of European market was mainly led by favorable sales of EVs by the VW and Stellantis groups. The North American market recorded a higher growth compared to China and Europe, thanks to strong sales of Tesla and Hyundai.

After

major countries in the world, including China, decided to terminate the EV

subsidy policies or reduce the amount of EV subsidy at the end of 2022, most of

EV market outlook was focusing on a possible slowdown in the market, also

affected by high interest rates. However, unlike the initial concerns about sluggish

market growth, the global EV market in 2023 still saw a solid demand and, for

now, with the data accumulated from Jan to Nov 2023, it is expected that the global

EV market in 2023 would post approx. the thirties.

Currently, concerns about a market slowdown have continued as the high interest rate around the world has sustained and economic downturns prolonged. With the global EV penetration rate exceeding 15%, those initial EV demand from early adopters did not seem to continue any more, and the EV market now seems to enter the chasm zone. In order to cross the chasm, it seems to necessary to expand the EV line-up at affordable prices while the trend in EV market has been transitioning from vehicle performance-focused to price-focused one.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period.